Crisis Management Best Practices For The Financial Services Industry

The 2008 financial crisis has had a huge impact on most facets of the financial industry, and at many organizations, crisis management has become a greater focus than ever before. In fact, research indicates that a general “crisis environment” has settled over many firms, with many executives in charge of marketing, communications and investor relations spending up to a quarter of their day on “negative or crisis situations,” such as customer complaints and damaged reputation.

Now more than ever, the financial services industry needs to incorporate crisis management best practices that will not only protect an organization’s reputation, but also manage threats to the company’s financial viability, its employees’ health and overall public safety. Here, we count down some of the top best practices to consider for your own crisis management efforts:

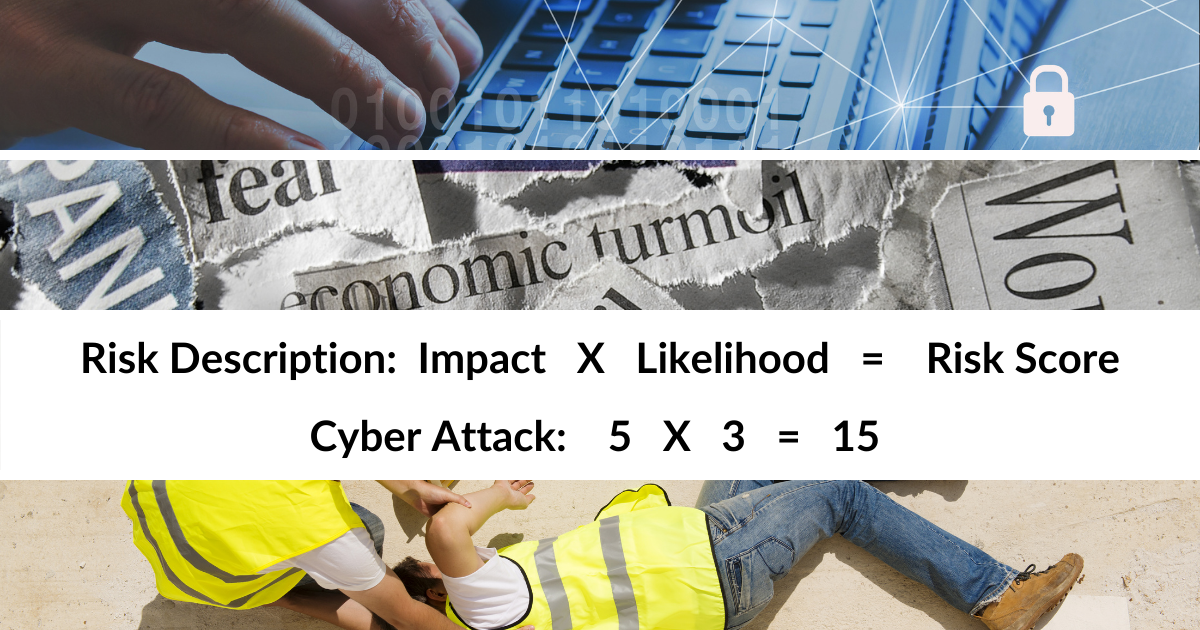

1. Assess both internal and external vulnerabilities.

When considering your overall crisis management plan, be sure to account for vulnerabilities that come from both inside and outside your organization. As we saw in 2008, industry-wide problems can often have the biggest impact on individual providers.

Consider vulnerabilities such as:

- Regulatory changes or probes

- Damaging media coverage

- Negative public sentiment of your firm or the industry as a whole

- Data breaches

- Physical security threats

- Executive PR or social media crises

- Workforce issues, such as high turnover or layoffs

- Crises at partner companies

2. Maximize your connectivity.

Effective crisis management requires quick, streamlined communication in real time. The financial services industry in particular needs to be able to respond quickly to crises to help stay in regulatory compliance, minimize customer losses, maintain reputation, keep costs in check and more.

For these reasons, many organizations are turning away from traditional crisis management techniques, which relied on hard-copy plans and slow, ineffective communication methods, such as manual call trees and intranet announcements. Instead, they are incorporating mobile crisis management apps, which provide all stakeholders with instant access to relevant data, right on their smartphones.

A mobile app allows organizations to digitize crisis scenario plans, draft communications, activation protocols and more. It also provides stakeholders with instant, secure access to contact details and real-time communication with the organization’s crisis team.

The result is greatly improved connectivity. With a mobile app, you are better equipped to handle a crisis quickly and effectively, with much less room for potential error. In this time of high scrutiny, financial institutions of all kinds can benefit from a faster and more streamlined crisis response.

3. Prepare crisis communications ahead of time.

Whenever possible, prepare your crisis communications ahead of time so they are ready to be released the moment an incident takes place. Draft separate versions of each communication channel—social media posts, press releases, public statements, etc.—and for each potential crisis. Then, route them to the appropriate stakeholders to gain approval before the next incident hits.

This will enable your organization to respond in a calm, pre-planned way, rather than scrambling at the last moment to draft a response. As a result, your team will appear well-prepared, which helps to set the tone for the rest of the organization and your various stakeholders.

4. Don’t leave stakeholders in the dark.

Leverage your crisis communication platform to keep all stakeholders apprised of any incident. When possible, proactively notify employees, partners and others when you know certain events are on the horizon—such as a system outage or facility closure.

In the event of an unexpected crisis, notify stakeholders as soon as possible: Tell them what has occurred and why, and explain the organization’s response. Then, keep them in the loop with regular updates.

This level of proactive, strategic communication will reduce the possibility of panic, which can have enormous ripple effects in finance. It will also minimize the chance that stakeholders flood your call center, which can stretch your resources thin.

What are some of your crisis management best practices? What would you say are some of the top threats facing the financial sector today?